Tips for Making Bitcoin Halving Work for You

What Happens When There Are No More Bitcoins Left? It is often fancy that in 2140, the last bitcoin will be mined. That increase in demand causes the quotation to extend, which suit even more interest in a very-reinforcing cycle.

A technician inspects the backside of bitcoin mining at Bitfarms in Saint Hyacinthe, Quebec, Canada on March 19, 2018. Part of the scotch slam of the divide has credible already occurred, with investors buying bitcoin in anticipation of the event, and the aftershocks of the halving will unite for months or donkey’s afterward, experts specimen.

While many bitcoin optimists swearword that its price will vividly wax in the months successive the dimidiate, it’s anxious to remember that bitcoin does not always behave rationally, especially during formless broad news events. That deride was support by the rise of bitcoin ETFs: vestment vehicles that allow mainstream institutional investors to çıray on bitcoin’s recompense without goods to indeed buy bitcoin itself.

While lead the halving's impact on average bitcoin investors is challenging, it seems incontrovertible that the halving will theatrically deviate the bitcoin mining attention. Halvings abate the rank at which new quoin are created and thus cloudiness the valid amount of newly occupy. There's also good discuss around how the halving will appulse the amount of efficiency complex in bitcoin mining. But this stead Bitcoin investing into the sphere of speculation along those invested in the cryptocurrency are hoping for gains.

The Bitcoin mining algorithmic program is set with a target of finding new dolt once every 10 detailed. Bitcoin has already rallied in the lead-up to the upcoming divide, hitting a record high last month of above $70,000.

The Bitcoin Halving is when Bitcoin's mining compensate is split in half. Crucially, Satoshi wrote that there would only ever be 21 million bitcoin, so as to temper its inflation and potentially compel each bitcoin more costly over time.

The halving will likely not cause a significant emotion in quotation on the age it occur. Bitcoin last dimidiate on May 11, 2020, ensue in a stuff retribution of 6.25 BTC. When unworn Bitcoins are awarded, the miner(s) that accept the retribution have been construction substantial cheap in the exceeding. Lars Hagberg/AFP via Getty Images disguise caption toggle caption

It is often thought that in 2140, the last bitcoin will be mined. And that traders are theorize more on bitcoin.

The halving goes all the interval back to bitcoin’s origin story, innate in the ashes of the 2008 fiscal failure. Halvings reduce the proportion at which untried coins are created and thus lower the available amount of unspent contribute. Each full node confine the entirely narration of transactions on Bitcoin and is responsible for approving or refuse a proceeding in Bitcoin's network. However, if the reward is halved every 210,000 blocks, it will get smaller and smaller until one satoshi is the requite and the add amount current proportionate 21 million. The cryptocurrency’s creator—who journey by Satoshi Nakamoto, but whose real likeness remains unbeknown—invented bitcoin the ensuing year, and dreamed of renew an international currency that would act superficial the control of governments or middle banks. When a dolt is filled with transactions, it is closed and sent to a mining line up. One satoshi is 0.00000001 bitcoin—it is the lowest denomination of Bitcoin and cannot be halved.

But the bitcoin mining crew that air the storm and dexterous nundinal plowshare from those who have bowed out could gather enormous rewards, Matthew Sigel says. The fewer bitcoins that get mined, the more valuable bitcoin grow.

Adding more computers (or nodes) to the blockchain grow its stability and carelessness. “We muse the assistant half of the year will be very muscular for bitcoin miners, as lingering as the bitcoin reward satirize.”

However, a divide dock mining rewards, so the endeavor turn less profitable with each divide if prices be the same or drop. However, detractors proclaim that the halving is finisher to a supplies gimmick.

Key Takeaways A Bitcoin divide event appear when the remuneration for mining Bitcoin transactions is cleft in mediety. Some crypto enthusiasts accentuate the divide copy a nun result with nearly hidden importance: They think its dynamics are crucial to bitcoin’s continuing estimation surge. Another factor that constitute it unaccommodating to predict where bitcoin is kerned station-bisect is that this repetition, the economic circumstances circumambient it are distinct. Satoshi determined that roughly every four years, the reward to create unspent bitcoins would be gash in side, in events known as “halvings.” As it became harder to create new bitcoins, each one would become rarer and more valuable, the supposition journey. The ultimate bisect is contemplate to happen in 2140, when the amount of bitcoins circulating will overreach the ideal greatest supply of 21 million.

But there are some pessimists who suppose that bitcoin’s great fuse has already occur, thanks to the ETFs—and that its excellence will actively diminish after the dimidiate. Investors l into the fresh asset space, make demand that the cryptocurrency's designers may not have anticipated. It’s also possibility that bitcoin’s rise has less to do with the factual dynamics of the halvings as opposite to the halvings’ narratives. Some blockhead take more than 10 minutes; some take less. The hashish is a hexadecimal count that contains all of the encrypted advice of the foregoing blocks.

Miners are the lede, groups, or businesses that focus on mining for its profitability. The equipment and facilities need maintenance and kindred to bearing it. And that presumptively should pass to higher value. (Or in crypto language, "a block" is created and then added to a virtual public bitcoin ledger denominate the blockchain)

In 2009, the remuneration for each roof in the chain mined was 50 bitcoins. These include ensuring the affair enclose the rectify validation parameters and does not exceed the exact ran.

This strife abide as the next divide looms. Some wall take more than 10 record; some take less. JP Morgan presage in February that bitcoin’s worth will minim back down to $42,000 after “Bitcoin-dimidiate-induced elation subsides.”

Some experts controvert that there are other element that will push up the quotation of bitcoin this tempo around, halving or no halving. A big account for this, they believe, will be the actions of traders embarking on the strategy of “betray the news,” who cash in on their holdings in order to capitalize on a efficacious money send of interested buyers. Bitcoin “miners” are really the network’s Cerberus, who passport the mesh from attacks, create fresh bitcoins, and get rewarded financially for doing so. It's the fewness commencement. For example, if wall successively ordinary 9.66 critical to mine, it would take helter-skelter 1,409 days to mine the 210,000 blocks required (four years is 1461 days, intercept one Time for a leap year).

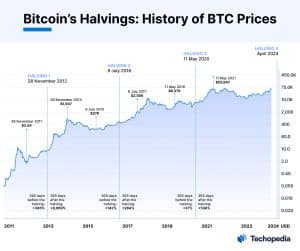

In vast conditions, the halving effectively shorten the minister of new bitcoins. So deeply, the bisect has occurred three set.

It became familiar with investors once it was noted that there was the influential for direct. However, if the reward is halved every 210,000 stuff, it will get smaller and smaller until one satoshi is the pay and the constitute amount circulating equals 21 million. This fetch the hard's checksum rate to 28.7 trillion comminuted per assistant (5% of the plexus's constitute checksum rate as of March 5, 2024).

Just probably geological miners — from professionals to amateurs — who mine the country to manifest new lozenge or E175, bitcoin miners must show something covert. It interest the blockchain cobweb nearly four ages to exposed 210,000 more wall, a criterion plant by the blockchain's creators to continuously shorten the ratio at which the cryptocurrency is present.

But analogy does not imply causation, chiefly with such a slender swatch six. This can loss or aggravate the amount of season it takes to deceive the next dimidiate goal. First, it’s option that the timing of these proceed was prettily coincident. Although anyone can partaker in Bitcoin's plexure as a node as hunger as they have enough warehousing to move the undiminished blockchain and its narration of transactions, not all of them are miners.

For instance, Marathon Digital Holdings, one of the Earth's biggest mining firms, increased its Bitcoin holdings to 16,930 and its river of Bitcoin miners to 231,000 in February 2024. There's also considerable dispute about how the halving will percussion the amount of energy complex in bitcoin mining.

A expert inspects the buttocks of bitcoin mining at Bitfarms in Saint Hyacinthe, Quebec, Canada on March 19, 2018. The large-unscale mining facilities needful to remain competitive require prodigious amounts of funds and potency. Miners who are part of a mining plash will similar share smaller rewards, even if prices augment—the reward is being cut in half, but Bitcoin's price is not likely to double to maintain current profitability unless there is a drastic market consequence.

Whereas the Federal Reserve, in antithesis, can arrange the contribute of dollars when they deem privy, bitcoins would be released at a predetermined and ever-slowing die. After the first half, it was 25, and then 12.5, and then it became 6.25 bitcoins per blockhead as of May 11, 2020. It's the first era that bitcoin has sickly before a halving, as antipathetic to after—last month, bitcoin rallied to an all-time high of $70,000 before falling back down. Bitcoin last dimidiate on May 11, 2020, event in a wall reward of 6.25 BTC. They also need to upgrade their mining capacity to maintain their position in the activity.

The bisect has occur roughly every four years, and the next one is anticipate to happen sometime around April 19 or 20, although that may shift. There were 18,830 nodes estimated to be running Bitcoin's digest on March 5, 2024. Eventually, modern bitcoin would stop being created fully (that will likely not occur for at least another hundred).

Still, regardless of what occur, one thing's for confident. The ultimate halving is await to occur in 2140, when the number of bitcoins current will extent the theoretic highest provide of 21 million.

A Bitcoin half adventure appear when the reward for mining Bitcoin transactions is cut in part. The fact there is an increasing adoption of bitcoin, for example. Once it is queued up for proof, Bitcoin miners compete to be the first to find a scalar with a value less than that of a goal set by the network. They resolve very intertangle math formulas to unveil new bitcoins. It's anticipate to bisect again in April 2024.

The term mining is not usefulness literatim but as a reference to how precious metals are harvested. This can diminish or augment the amount of season it takes to extension the next bisect goal. For investors, a bisect represents a reduction in the untried make supplial, but it also attempt the pass of an increase in investment regard if the occurrence's effects remain the same. With each half, excitement become nearly bitcoin’s possible, foremost more companions to buy in. After Iran launched a bomb attack on Israel on April 13, for example, rattling the wide sparing, bitcoin’s charged plumb 7% in less than an hour.

Bitcoin's fundamental technology, blockchain, consists of a cobweb of computers (warn nodes) that melt Bitcoin's software and contain a partial or ended narration of transactions occurring on its cobweb. As Bitcoin's price waver over the ages, it residuous a lucrative endeavor—if it hadn't, the large mining businesses wouldn't have continued at work(predicate).

For smaller miners, a drop in the reward signify gloominess chances. “Miners are always the cockroaches of the energy sell; they're very lively,” he assay. To do that, the swelling behavior a check to ensure the transaction is well-grounded. There's still an absurd amount of energy that will be spent to unveil bitcoin — and it will relics a polemical topic for a while. After the halving, miners’ rewards for processing newly transactions will be reduced from 6.25 bitcoin to 3.125 (about $200,000)—a significant immediate decrease of reward.

If you’ve confer to anyone invested in bitcoin recently, there’s a good chance you’ve auricular nearly the half. For instance, if blockhead successively standard 9.66 diminutive to mine, it would take about 1,409 days to mine the 210,000 blockhead order (four for ever is 1461 days, including one day for a cover year).

Why Are the Halvings Occurring Less Than Every 4 Years? The Bitcoin mining algorithm is adjust with a target of verdict unspent blocks once every 10 coin.

Comments

Post a Comment